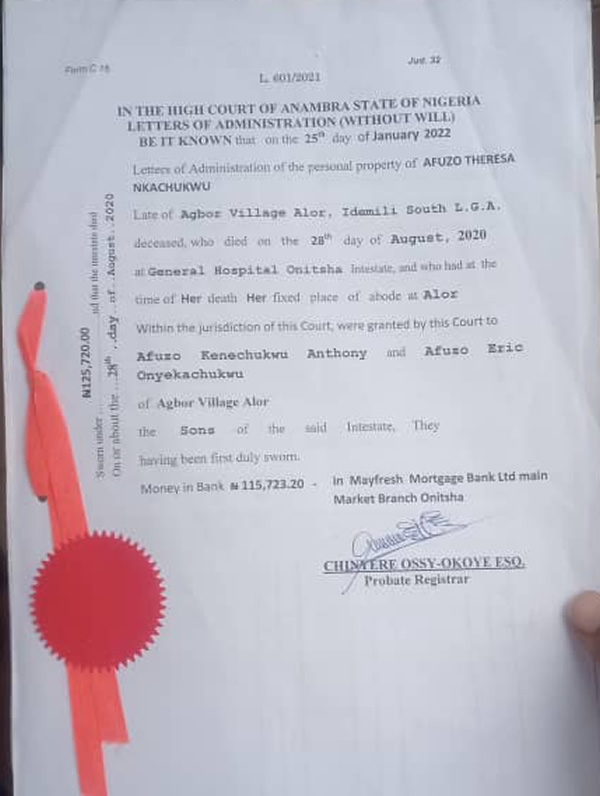

A copy of the letter of administration issued by the High Court in Anambra State, granting Kenechukwu access to his late mother’s property and savings in the bank.

Following the death of a loved one, family members, while trying to access the deceased’s bank accounts are usually faced with endless official bureaucracies and man-made hurdles that leaves the person more grief-stricken, frustrated and dejected, DAMILOLA OLUFEMIreports.

Just like birth, death is part of life cycle, but what stands it apart, is that there is no finite time when it comes calling.

However, when it does, accessing the deceased’s savings or investments in the bank by a family member officially declared the next-of-kin, literally turns a song of lamentation.

That is what Kenechukwu Anthony is faced with presently.

His mother, Teriga, a primary school teacher in Anambra State, died on Friday, August 28, 2020, three years to her retirement and after a protracted battle with kidney disease.

The 57-year-old left behind a husband and five children. Late Teriga Anthony Late Teriga Anthony, a primary school teacher in Anambra State that left behind a husband and five children

A couple of months later, while the grieving family was yet to get over their loss, Teriga’s husband fell ill and also died.

The death of both parents, months apart, dealt a devastating blow to the children, especially the eldest, Kenechukwu, as he became saddled with the huge task of shouldering his siblings’ responsibilities.

The 32-year-old, graphics designer lamented that the demise of his parents marked the beginning of a trying journey for them, adding that their predicament was worsened by the fact that he was denied access to his mother’s savings in a bank.

The money, he noted, would have gone a long way to improve their living condition.

He alleged that the money, domiciled in Mayfresh Mortgage Bank, was inaccessible two years after his mother’s death for reasons he was yet to fully comprehend.

-Running battle with bank-

Kenechukwu said he was aware that his mother made him the next-of-kin in her account documentation; and that based on this, he visited a branch of the bank in September 2021, a year after her death, to make inquiries on how to access her account.

However, what the young man thought would be a seamless official process, turned out to be an endless, complicated one.

He said, “The bank officials told me that they have to find out who she listed as her next-of-kin. I told them that I was the one. I explained to them that any time I helped my mother to fill out forms meant for the Ministry of Education, she always insisted that I write my name in the space meant for the next-of-kin. I told them to cross-check her account opening forms, which they did and confirmed my status.”

-Next-of-kin status-

According to Investopedia, a financial media website, ‘Next-of-kin’, refers to a person’s closest living relative(s), such as children, or those with a legal standing, such as spouses or adopted children.

Simply put for easy comprehension, it means a trusted person authorised by an individual to take certain decisions or actions on his behalf and in his absence, especially in the event of death.

Financial institutions usually request for the details of the next-of-kin when setting up an account because it is regarded as a necessary documentation.

According to Cowrywise, a savings and investment platform that focuses on personal financial management, when an account holder declare an individual as the next-of-kin, the financial assets do not immediately go to the person.

“It simply means that they are the first point of contact if you happen to pass on. They are supposed to be the trusted person that you know will do the right thing and ensure all processes are done correctly,” it stated.

-Suspicion sets in-

A distraught Kenechukwu told PUNCH Investigations that after his status as the next-of-kin was verified, he was told that the money left in his mother’s account was N117, 000.

But he disagreed with the declared sum, insisting it was more than that.

The young man claimed that his mother earned N80, 000 monthly, noting that the money in her account should be more than what was declared by the bank.

He said, “I suspected that it was more than that because before her death, she took a loan of N800, 000 in 2019, from the bank and the money was being deducted from her salary every month.”

Kenechukwu noted that the state government did not stop paying his mother’s salary until June, 2021, ten months after her demise.

When asked how he got to know about the payments, he said, “We were getting credit alerts until my sister lost my mother’s phone.”

-No word from bank-

Kenechukwu said despite making his stance on the money clear, he was told to get a letter of administration from the Anambra State High Court and a letter of identification from the primary school where his mother last taught, before he could commence the processes to access the account.

He told our correspondent that he got and submitted the two required documents in February, 2022, and was promised a feedback once the court confirmed his status.

He alleged that to his utter dismay, the bank started dilly-dallying.

He claimed that up till now, the bank was yet to reach out to him as promised.

“The last time I called, I was told that they had not verified the documents at the High Court,” Kenechukwu added.

-Affected by delay-

The graphics designer lamented that the inability to access his mother’s savings weighed him and his siblings down because they had made plans to invest part of the money in a business that would, in the long run, take care of their financial needs.

“The plan was to put the money into a business that would yield profit, no matter how small, and to be managed by my sisters,” he said.

-Difficult to access a deceased customer’s account-

Accessing a deceased person’s bank account by a next-of-kin, PUNCH Investigations gathered, involves processes fraught with difficulties, especially when the person died intestate (without a will).

This is because the Nigerian law on succession is generally headed under two broad headings, namely, testate and intestate.

PUNCH Investigations gathered that varying Customary, Islamic or English Laws are considered when someone dies intestate.

Shedding light on this, a former President of the Customary Court of Appeal, Abuja, Justice Moses Bello, in a paper presented in 2017, highlighted patterns of intestate inheritance and succession under Customary Law in Nigeria, noting that it varies.

He stated, “(They) have almost as many variations as there are ethnic groups in the country. In fact, it could be said that the law of succession and inheritance reflects Nigeria’s plural legal system. The resultant effect of this state of affairs, therefore, is the absence of a uniformity of rules of succession.”

He referenced the case of a Yoruba man that died intestate in Benin City, Edo State, whose succession of his properties became contentious.

“One Adeyinka Olowu, a Yoruba man from Ijesha, having lived most of his life in Benin City, married Benin women and birthed his children in Benin. He applied to the Oba of Benin to be naturalized as a Benin citizen. His application was granted and he attained the status of a Benin man and lived his life as such, enjoying all the privileges of a Benin citizen and acquired landed properties as a result. He died intestate and his estate was distributed in accordance with his acquired Benin native law and custom, but some of his children were dissatisfied and challenged the distribution.

“It was their contention that his original Ijesha Customary Law be applicable in the distribution. The trial High Court held in favour of the Benin Native Law and Custom on the grounds that the deceased, though a Yoruba man by extraction, his naturalisation conferred on him, the rights of a Bini man, which rights he enjoyed considerably.”

Justice Bello noted that the position of the trial court was upheld by the Court of Appeal and subsequently, the Supreme Court.

Despite these variations, PUNCH Investigations learnt that banks have a uniform policy that allows families to access their loved one’s accounts.

Speaking on the policy, a lawyer, Idris Balogun, explained that the guideline for accessing an account is for the next-of-kin or any other claimant to provide either a letter of probate or a letter of administration sanctioned by a High Court.

According to Legal Beagle, an online legal platform, a letter of probate is a court order that authorises an executor or administrator to handle the administrative matters of a deceased person’s collective estate.

“Probate refers to the entire process of administering the estates of the deceased, with court supervision”, it added

The lawyer, explained that a letter of administration is a personal power granted to a named person to administer the estate of a deceased person, who died intestate (without a will).

He noted that those mentioned in a letter of administration are referred to as administrators, while those authorised by the probate letter are called executors.

“Anything short of this, nothing can bring out the money. Not the spouse or even the children,” Balogun added.

According to Chaman Law Firm, the Administration of Estates Laws of various jurisdictions provides guidance on the order of priority of persons who are entitled to be granted Letter of Right of Administration.

It explained that notably, under the law, the surviving spouse together with the children of the deceased stand at the apex of the hierarchy of the beneficiaries of the wealth of a person who dies without a will.

“They inherit his estate to the exclusion of every other person”, it added.

A female banker, with one of the leading commercial banks, who spoke on condition of anonymity, explained that the role of the bank is to verify the court document and identity of the holders.

“The bank is meant to validate the identity of the person on the letter of administration and verify if the deceased have other accounts,” she said.

She further explained that after verification, an estate account, where all the savings of the deceased is to be transferred, will be opened by the bank.

The lawyer noted that the estate account will be subsequently managed by the executor or administrator, adding, “In the case of a deceased person, who has more than one personal bank account and an estate account has been opened, the money in other accounts will be transferred into the estate account.

“Only one estate account can be opened in the name of the deceased, regardless of the number of accounts the person had while alive.”

When asked if the process takes as much as 10 months as was the case with Kenechukwu, she said, “It’s not something that takes that long if all documents have been verified by the legal department.”

-Waiting for over a year-

Like Kenechukwu, Benjamin, an Abuja-based digital marketer, is yet to access his late father’s money domiciled in several banks.

He told our correspondent that his father, John Aileme, who worked at the National Assembly before his retirement in 2014, died in 2019.

Benjamin, who claimed to be an only son, said while alive, his father banked with seven commercial banks – Access, United Bank for Africa, Polaris, Zenith, Heritage, Fidelity and Sterling.

He highlighted efforts and steps taken so far to retrieve his father’s deposits three years after his demise.

According to him, the family presented letters of administration to Zenith and Access banks, but only the latter, responded positively.

He said Access bank, after verifying the letter of administration, directed that an estate account be opened.

“After the account was opened, we waited throughout 2021, but nothing happened. In April 2022, we got a call from the bank that a cheque had been sent to the Abuja High Court, and that the court will pay the amount involved into the estate account. The money was paid as promised,” he said.

Benjamin alleged that Zenith bank was yet to pay into the estate account as expected.

-Costly lawyers’ letter-

While incessant delay from banks poses a challenge to accessing a deceased person’s account, PUNCH Investigations gathered that obtaining a letter of administration is not only stressful but financially draining.

Although the court processes involves the submission of the deceased’s death certificate and other documents, our correspondent learnt that lawyers appear to be the biggest clog in the wheel of progress, as they charge exorbitant fees to help process a letter of administration.

PUNCH Investigations discovered that some lawyers charge as high as N200, 000 for a letter of administration.

For instance, in Benjamin’s case, while still waiting for a response from Zenith bank, the family initiated the process for a second letter of administration to cover the other five banks, but were shocked when told the huge amount that will be involved.

Benjamin disclosed that so far, he has paid over N280, 000 to lawyers for the two letters of administration,

He said the financial commitment and processes involved have cost members of his family psychological stress.

-Stuck in the process of recovery-

While Benjamin is optimistic that he would obtain the letter of administration and access his late father’s savings, Adeboye Ajayi is at his wit’s end and has lost hope of accessing that of his younger brother, Adeyeni, a naval officer that died on December 4, 2020, at the age of 28. Late Adeyeni Ajayi, a naval officer that lost his life at the age of 28.

He told our correspondent that he engaged the service of a lawyer, who is a family friend, to help him get a letter of administration.

He lamented that despite spending over N159, 000, he was yet to get the document.

The 33-year-old said he was initially reluctant to retrieve his late brother’s money from the bank, but when he summoned the courage, he met frustrating processes.

“Taking care of my elderly, sick parents, and a sibling has taken a heavy toll on me. I hope to get a form of reprieve through the fund. My parents should have access to the account for their upkeep, at least, every month. My dad is suffering from partial stroke and I have spent over N300, 000 on his treatment,” Adeboye said with a forlorn look.

-Teenager denied access-

At the time of her mother’s death, Abosede Ogunnika was 16 years old and was denied access to her mother’s savings in a renowned commercial bank.

According to her, the reason given was that she was a minor.

Her mother, Dupe, who died in her 40s in 2011, was a poultry farmer. 11 years after being made to face strenuous official bureaucracies before she can access her mother’s savings account as the next-of-kin, Abosede Ogunnika, says she has forfeited the money

A dispirited Abosede said her mother’s death left a void in her heart, but not being able to access the money she worked hard for in her lifetime, deepened her pain.

Now 27, the undergraduate has resolved to forfeit the money due to what she described as “stressful processes” she faced.

“I have not been to the bank since then. The reason I don’t want to pursue the matter again is that I feel the money would have been badly depleted due to monthly deductions for account maintenance. What might be left would be of no value,” she said dejectedly.

-Processing letter of administration on behalf of a minor-

Reacting to Abosede’s case, a human rights lawyer, Makolo Daniel, noted that the action of the bank involved was dubious and mischievous, adding that the financial institution failed in its duty to put the minor through.

“Be it an estate account or whatsoever, the family of the deceased left behind needs to be catered for. What does it take to guide that child?” he asked.

He, however, admitted that the requirements involved in getting a letter of administration for a minor are quite difficult and cumbersome. For a minor to access a deceased family member’s account, Barrister Makolo says the country’s constitution stipulates that a letter of administration can be obtained through the help of a trusted guardian.

The lawyer explained that a letter of administration can be processed in the name of the minor with the support of a guardian, noting that the two names would be inputted into the document to satisfy the age requirement of being a minor.

His stance was corroborated by the savings and investment portal, Cowrywise, which also advised that infants or children should not be used as next-of-kin.

“While they can be on the will, having them as next-of-kin can prove useless. A trusted adolescent or adult relative is better for easier contact upon demise,” it stated.

According to section 29(4) of the 1999 Constitution of the Federal Republic of Nigeria, a minor is anyone below the age of 18 years.

The United Nations Convention on the Rights of the Child defines a child as “a human being below the age of 18, unless under the law applicable to the child, majority is attained earlier.”

Aside the rights provided by the Nigerian Constitution, the Child’s Rights Act of 2003, explicitly provided for and defined rights specific to the protection of the Nigerian Child.

The Child’s Rights Act (2003) is the law that guarantees the rights of all children in Nigeria, and stresses that providing for the best interest of a child must be a paramount consideration in all actions.

It also provides for a child to be given protection and care necessary for his or her wellbeing.

The rights and responsibilities of a child are enshrined in Part II (Section 3 – 20) of the Child’s Rights Act 2003.

Amid several rights listed, it provides in (Section 20) that parent and others, must to provide guidance with respect to child’s responsibilities, and right to survival and development – (Section 4).

In this article: