How developing countries have failed to reap economic benefit of urbanisation

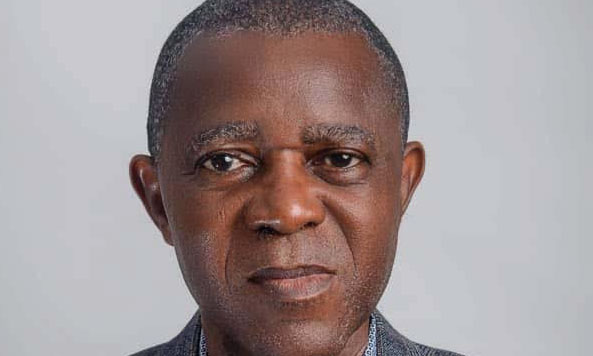

Mr. Kunle Awolaja is the new president of African Real Estate Society (AfRES) and a fellow of the Nigerian Institution of Estate Surveyors and Valuers (NIESV). He spoke to VICTOR GBONEGUN on the problem associated with housing provision in the continent, ways to stimulate growth in real estate and collaboration to ensure development of the property market.

The real estate sector in Africa is growing at a slow pace despite huge potential that can trigger increased growth. What are the issues and strategies needed by players in sub–Saharan African (SSA) countries? I would like to appreciate your media house support for real estate practices in Nigeria and the continent at large. Indeed, economic and political instability, as well as civil unrest have affected several sectors in Africa, including the real estate industry.

In solving these challenges, there is a need to encourage foreign direct investment in the real estate sector. This would expand the housing supply, which in turn reduces the housing deficit, and exorbitant pricing in the regions. There is also a need for collaboration among research institutes, professional bodies, and government agencies to generate accurate data on housing stock in the sub-regions. Long-term and single-digit mortgage financing should also be encouraged, alternative cheap funding and housing subsidies should be provided at the sub-regional levels, while incentives and tax relief should be availed to building materials manufacturers to reduce the cost of building materials.

An effective and efficient land titling and registering process, which should be time-bound should be encouraged. The sub-regional government should adopt the digitalised titling and registration process as we have in Lagos State (LaGIS), Kaduna State (KadGIS), FCT Abuja (AGIS) among others.

There are worries about the dearth of affordable housing, social housing, and sustainable financing models. What is responsible for these inadequacies? Africa is currently faced with the challenge of rapid urbanisation and it is expected to double its population, especially in the urban areas by the year 2050. The population growth in the cities has increased the demand for housing, commercial space, and other infrastructure, which has made investments in real estate more attractive to investors. Like in Western countries, where housing is regarded as one of the major responsibilities of the government to their citizens, especially for low-income earners, affordable housing has been a mirage in most African cities. Most of their cities are saddled with the problem of inadequate housing supply as against the hyper-housing demand, especially for the low and medium earners. The problem is caused by the high cost of land acquisition and property title perfection, the high cost of building materials and over-reliance on imported building materials, lack of long-term finance coupled with high interest rates, lack of an effective mortgage system, fluctuation in foreign exchange rates in the sub-regions are amongst the contributory factors. The real estate industry is also challenged with a lack of adequate manpower in terms of artisans, semi-skilled, and skilled professionals to handle some specific jobs in the industry, as well as technical know-how on modern practices within the sector.

The African Continental Free Trade Area (AfCFTA) agenda has been at the planning stage for years without achieving its goal for the continent. What impact do we expect from the initiative on the estate market and services? AfCFTA is a free trade area agreement within most of the countries in the African continent. It was established in 2018 having 43 parties and another 11 signatories to the agreement, making it the largest free trade area by number of member states after the World Trade Organisation (WTO). It is committed to eliminating tariffs on most of the goods and services amongst member states in the continent through its long-term objectives of creating a single, liberalised market and minimising barriers to capital and human movement to facilitate investment, as well as develop regional infrastructure amongst member states. The goal and achievements are still far-reaching from the initial objectives due to several challenges such as; significant part of the financial and technical support needed by the organization is from external partners. This source of support tends to pose issues relating to sustainability and diverse interests; variance between the continental aspirations and national priorities of the member states affects the implementation of the AfCFTA agreement, which is evidenced in the delay in the completion of the Rules of Origin Negotiation and significantly wide gaps in trade facilitation measures such as transportation infrastructure and logistics, and economic resources to facilitate trade activities amongst member states on the continental, national, and regional levels. This differentiation poses a great challenge to the organisation. Essentially, the increasing complexity of agreement is confronted by varying capacity levels on the national fronts with a mandate of its implementation by member states. Also, language differences, cultural differences, member countries and the loyalty to their colonial masters, differences in currency spent amongst member countries, as well as difficulty in changing currencies within the continent are a lock on the wheel of the organisation.

World Bank projects that Africa could have as many as 1.2 billion urban dwellers by 2050 and 4.5 million new residents in informal settlements. How will the real estate sector benefit from the growth in population? Sub-Saharan Africa has a mixed story on urban population growth. The growth in urban population in countries like Nigeria and Ghana resulted in growth in the Gross Domestic Product of the countries, while on the other side, the growth in urban population in countries like Zimbabwe, Madagascar, and Guinea-Bissau resulted in a reverse experience. Cities in developing countries have failed to reap the economic benefit of urbanisation. This is largely because these cities are not able to cope with the forces that drive the structural transformation and create jobs in tradable industries, which contributes to the national economic growth as it was achieved in countries like China and most of the developed states. Despite the challenges of urbanisation in Sub-Saharan Africa, it has several benefits for all the sectors of the economy including the real estate sector if only it is effectively managed, which are that it would result in to increase in economic growth that is more people would increase the demand for goods and services such as food, housing, and shelter. It would result in an increase in investment in the provision of critical infrastructure to unlock the full potential of the urban area such as the provision of quality transportation network, power, communication, and other essential amenities like mass housing, schools, health care facilities, and security facilities among others. This would attract more investors and drive economic growth, resulting in the industrialisation of the economy, that is, the economic activities moving from the primitive approach to production to a mechanised approach with a purview of catering to the increasing demand for goods and services. It would also open up employment opportunities and job creation in the economy such as developing people with competence and expertise in urban renewal and regeneration process to avoid urban sprawls and blight.

Investors’ appetite in certain segments of the real estate market has remained despite challenges in transactions. How should governments in the region stimulate growth in critical sub-sectors of the industry? There is a dire need for all governments at the sub-regional, regional, and national levels in Africa to provide efficient and effective policy documents on land administration and management, provide infrastructure support, and ensure transparency in the land titling and title perfection process. They should also provide incentives and relief of private investors on critical sub-section of the economy as well as regulate and stimulate economic growth in the continent. There is also a need for the public sector to ensure partnerships with the private sector in real estate development in the provision of an enabling environment for business growth, while private investors should concentrate on bringing their competence and expertise, as well as funding to the actualisation of economic growth.

Experts have raised concerns about the absence of data in Nigeria that could guide investment decisions in the real estate market. Do other African countries have similar challenges? What can be done to erase these concerns among prospective investors? Yes, they have similar challenges. There is a need to organise real estate professionals with the purview of creating a database/databank for all property transactions. A real estate database is an organised set of data related to buying and selling property. The relevant information stored in a commercial real database includes asset types, location, size, zoning, ownership and lease information. We need to digitalise the land resources in all countries through the adoption of GIS, Geospatial analysis, and MapInfo techniques. Deploying technologically (Proptech) enabled property listing that helps in data collection; acquisition, data cleansing, data validation, identifying when a listed property has become outdated, as well as property list management and frequent platform maintenance, which is driven towards prospective investors’ expectations and confidence would be of immense benefit. As the new president of AfRES, an affiliate of the International Real Estate Society (IRES), what could improve the relevance of the society across Africa? The society’s mission is to seek to promote networking, research, and education amongst property professionals across Africa. To achieve this, in my tenure as the President of AfRES will ensure a robust collaborative interaction with all relevant international and national bodies such as Africa Development Bank (AfDB), Economic Community of West African States (ECOWAS) and National (Federal) / Regional (States) and government agencies in the area of providing advisory service on policies formulation, research development especially, in the building industry, as well as other support service that are directed towards the growth of the continent. The society will also partner with our sister professional bodies/organisations at the regional, national, and international levels to synchronise ideas, trends, and research on the real estate sector across the globe.