By Helen Oji

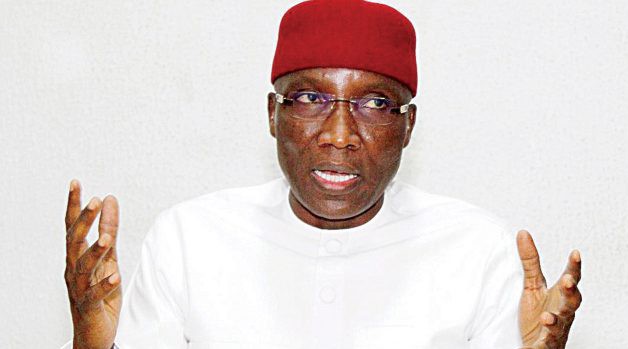

Dr. Iliyasu Gashinbaki is the President/Chairman of Chartered Institute of Forensic and Certified Fraud Examiners, an offshoot of the Association of National Accountants of Nigeria (ANAN). He told HELEN OJI why the country needs to build certified fraud examiners’ capacity and explains how the fraud examiners’ bill, which ANAN is sponsoring and garnering support for at the National Assembly, will aid anti corruption fight. What is the Chartered Institute of Forensic and Certified Fraud Examiners about? ANAN has been around for several years and has succeeded in training over 40,000 professionals. Yet, it felt that is not enough. ANAN, being the founder and sole promoter of this Institute, sees the need to have a specialised arm for forensic accounting.

The challenge with fraud is that career criminals are always ahead of the regulator and other professionals. That is why we always run behind because they understand the system and know its weaknesses. The Chartered Institute of Forensic and Certified Fraud Examiners will uniquely put on the table something different. It is different from any other law ever passed in this country because there is no law passed to build capacity in the area of forensics and fraud examination.

Secondly, ANAN has the Nigerian College of Accountancy and that college has been upgraded to a university. What we intend to do now is to create the Nigerian Forensic Academy and once the bill becomes law, we will have the Academy affiliated to the university to build the capacity of the tertiary institutions. The idea is to upgrade it to a regional university in Africa because what we are doing has never been done in Africa. We are combining two great areas, which is fraud examination and forensics.

Also, because this body is multidisciplinary, we will have diverse professionals under it – forensic architecture, criminology, law, sociology, medicine and so on, to deal with various ramifications of fraud. That also gives us the scope and competency to deal with the broad diversity of our economy and growing complexities of fraud.

Fraud and corruption are on the rise in Nigeria. What role will the institute play in curbing these hydra-headed challenges? The law enforcement agencies are doing their best. If you know what it takes to secure convictions in Nigeria, it is a lot because there are so many hurdles, from investigation to prosecution to the court itself. In fact, the entire criminal justice system needs to be seriously reformed.

Key areas of focus for our institute is to see that we deepen the institutional standard on capacity building of law enforcement agencies and the outcome is that their investigations will be much smarter while prosecutions will be much more on target so that conviction rate will increase. We are already working with ICPC and EFCC, and in all the professional training we have had, we had them at the final trainings.

What is the institute seeking to do differently? The general public usually thinks that accountants are either fraud examiners or forensic experts. That is not true. As accountants, we are mandated to keep and maintain records in a true and fair manner that is reliable, while the fraud examiner or forensic accountant looks for the minute details of fraud, not just accounts but the diverse ramification of fraud with the aim to ultimately find the evidence that will stand the test of time and nail the suspect.

How is the institute going to combat fraud in the country? Both ANAN and ICAN train accountants. Being an accountant gives one an advantage but other disciplines like law, economics, sociology, psychology and so on are also incorporated into the fraud examination exercise. Forensic is also diverse.

While we are using forensic accounting to dig out evidence that will stand the test of trial, forensic science is also used to get evidence that they use in convicting criminals. So I will say while being an accountant is an added advantage, forensics is multi-disciplinary, which explains why this bill is necessary.

The guarantee of this Chartered Institute to cage fraud and criminality is that this is the global best practice. I can guarantee that this body will significantly reduce the quantum of fraud both in the public and private sector.

How will the institute build capacity for EFCC, ICPC, and Police, among other bodies? Regulators and even the people in the forefront of the fight against corruption have not been able to understand that we need to build capacity. For instance, if you notice, by legislation, we have the EFCC, ICPC, and even the police with the prosecuting powers associated with anything that has to do with corruption. But we do not have a single professional body in Nigeria that is chartered and dedicated for the purposes of fraud examination and forensic accounting. What we have on the other hand is so much money going into prosecution but what about the training and capacity building of professionals that will service both the public and private sector in ensuring that we root out fraud and criminality? That is where we come in.

How will the passage of the bill impact the economy? When passed into law, it will deal with banking, insurance, capital market, judiciary and even legislative fraud. Let it be clear: EFCC and ICPC are prosecuting agencies. They have prosecuting powers. But the Chartered Institute is not a government agency. It is not going to be funded with government’s money; it is going to be funded by subscriptions and activities it will generate from its members.

Also, do not forget that Nigeria has joined the African Continental Free Trade Area (AfCFTA) and the implication of that is that money laundering, tax evasion, trade malpractices and all sorts of inter jurisdictional fraud, organised crime will double because we now have a huge market, and so many things will be liberalised.

So, if there is anytime Nigeria should take leadership position to become the epicentre for incubation of professionals for the country and for export as intellectual capitals, the time is now; and we can do that in the area of fraud prevention through this Institute. We can do that because Nigeria is one of the biggest victims of fraud.

How will the institute assist government in recovering looted funds? Our professionals are going to train judges to understand the depth and technicalities associated with fraud. If they are well trained, it will give them a deeper understanding of emerging trends that will help them deliver sound judgment. Also, the legislators will make sound laws and we will help law enforcement agencies build capacity. The importance of this body in the three arms and tiers of government is so germane that we think the charter will perhaps be the greatest gift the ninth assembly will give to this country.

Another aspect is the area of recovered loot. We will ensure that recovered loot is properly accounted for, and not re-looted. With the voice of a body like ours, Nigeria can ensure the speedy recovery of loots because some of them are still trapped abroad and these developed countries are putting in so many technicalities to delay the return of loots to Africa.

There is an argument that accountants also do forensics. What is your reaction to that? Forensics accounting is just an arm and it is not in the ICAN or ANAN act. On the day of the second reading of the bill, the member, who is a chartered accountant that opposed the bill was asked by the speaker to show where there is forensic accounting in the ICAN act, because it is not.

Right now, there is a bill before the house to amend the act to include forensics. It is not our bother at all whether ICAN includes it or not, but we are saying that the institute has been created to cater for forensics in all its ramifications and forensic accounting is just a part of it.

Today, there is no institution by legislation that is empowered to do forensics in Nigeria. So, even for ICAN claiming they are already doing forensics, it has not turned to law, it is not in their act.

So, why do we need the bill? The bill has passed first and second readings as well as public hearing at the House of Representatives. It is primarily to bridge the gaps in the Nigerian economy. What is that gap, it is that we need to have an independent, self-regulated, self-accounting, self-funded professional body that caters for forensic and fraud examination. The reason is that the institute will complement what the law enforcement agencies are doing, as they need to train and retrain. And no amount of money put there will be enough. The government does not even have the resources to do all that has to be done in that space when it comes to law enforcement agency.

Now, we need competent professionals that will help in ensuring that we reduce the incidence in key areas. So, it is not just for the law enforcement agencies and that is why as an institute, we are floating the Nigerian forensic and fraud examiners academy.

The academy is intended to be the engine room that will train professionals that will service both the public and private sector. The technical committee for the implementation of the academy has concluded work. By the end of the third quarter of this year, we will be done with the roll out of the academy. But even before the academy, we have certification programmes with various courses covering all these areas that I have mentioned – banking fraud, capital market fraud, insurance fraud, public sector fraud and all the other areas of fraud. We have various certifications that deal with that and as we speak, the institute trains different cadre of people.

How would you work with banks and other financial institutions to ensure that internal mechanisms are robust enough to fight cyber crime and internal fraud? There are so many interfaces, just like the support we provide to the law enforcement agencies. I think the private sector will probably be a greater beneficiary because in the banks and other financial institutions, you discover that they have risk management department and compliance officers. The compliance officers are not below the rank of a General Manager and risk management is a department of its own. What we intend to do is to isolate these key departments and make sure we expose them to the best tools available by ensuring that they are trained and retrained to discharge their duties well.

While we are talking about conviction rate going high, the level of bank, insurance, capital market and cyber fraud will significantly begin to go down by the time this institute is fully chartered.